Talking or even thinking about death is just something we Brits do not like to do. Instead, we pop the kettle on and have a cuppa. We tell ourselves that we don’t need insurance, it’s something to think about in the future, or that the worst will never happen to us. Instead of shelving those uncomfortable discussions, let’s talk about putting the pieces in place so that the people left behind are financially protected in the case that something bad does happen.

Life Insurance

Critical Illness

Income Protection

Talk to us about the options available and get the right advice at the right time and the right policy for you.

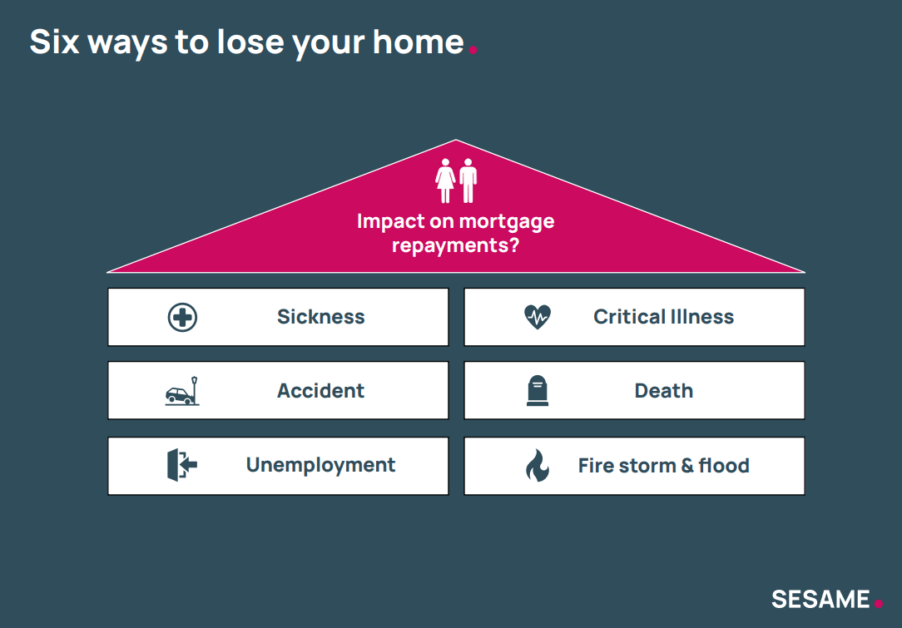

Protecting family and property is often the most important thing in our lives. However, being human means that we can’t always protect them. Accidents, illness, and death are all too common in daily life.

Life insurance protects those closest to you. It allows you to get the right cover so that in the event of your death, your family could carry on in somewhat the same way. There is the opportunity to leave a lump sum, enabling them to get back on their feet emotionally because financially, you’ve taken care of them.

Having insurance offers protection to your family, safeguards how they live and will cover any outstanding debt. Ensuring that the people closest to you don’t have to worry unnecessarily about the financial side of things.